welcome

-The fastest, easiest way to send money internationally-

powered by Advanced iFrame

How to convert currency and send it to india

-using payex plo-

Converting currency and sending it to India from abroad might give you a tough time, but it is more comfortable and secure as long as you have adequately researched. While searching for the right option for transferring money to India, you might come across a lot of the money exchange online services, but not every service will give you the accurate exchange rate and transparent charges. This is where Payex Flo shines.

Converting and transferring money to India was never as easy as it is with the Payex Flo. Payex Flo is an online money exchange third party platform that allows people to make secure, reliable, and quick online transactions internationally. No matter where you are, you can quickly transfer the money to India.

The platform has an online portal that enables its users to convert currency and transfer it around the world. You only have to fill in the needed details while using the website to send the money to the recipient. It might seem unreal to you, but when you log into the website, and follow the three steps to make the transaction, you will have an idea of how easy the whole process is.

There could be many situations and emergencies where one might have to send money to India from abroad. During these emergencies, people refer to banks to make transactions but end up spending too much on fees. However, there is no longer a time when you will be obliged to visit the bank to make a transaction to India. Now, making international transactions is as easy as sitting on your couch and typing on your laptop. You will require only a device with a secure internet connection to make international transactions with Payex Flo.

If you are looking for instant money exchange services to send money to your family, you are in the right place. In this post, we are going to elaborate on how easy it is to make international transactions with the Payex Flo for the lowest fees possible.

Converting and transferring money to India from abroad using Payex Flo

Payex Flo is one of the reliable money exchange online services that have been aiding people around the earth to make instant, secure, and easy transactions. Payex Flo is a reliable name in giving the most accurate exchange rates allowing people to send an almost tax free sum to their recipients. So, regardless of the destination and origin country, you can spend less money on fees that you would rather spend if you choose a bank transfer or companies such as MoneyGram.

Payex Flo is more reliable and secure than the other money exchange services. Though the most commonly used route to make international transactions is bank transfer, it is way hectic and a long process. This is why the money senders are happy and satisfied to make international transfers via this online platform. Thus, if you are looking for a money exchange online service that can help you make money transfers to India on a regular basis, then, Payex Flo can serve the purpose.

The easiest way to make an international transfer with Payex Flo.

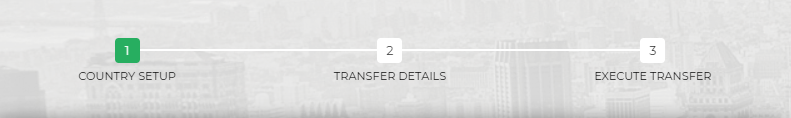

Making an international transfer with the Payex Flo is easy and simple. There are only a few steps that you need to follow while transferring money to India from another country. Once you reach the front page of Payex Flo, you need to follow three steps to confirm the transaction. Let’s take a closer look at these steps:

Three steps to initiate the transfer

The Payex Flo website demands three steps from you to initiate your transfer. These three steps are as follows :

These steps require your information that is essential to make the transaction. Let’s discuss each of these steps briefly. Keep in mind that your information will be safe and secure.

- Country setup:

First of all, you will be required to enter the country set up that involves the necessary information about the origin and destination country. For example, your country of origin where you are transferring the money from is the United States and the destination country is India, is where you want the money to be sent. After going through the basics, you will reach the next tab of “transfer details.”

- Transfer details

This step of transfer details requires your personal information. The personal details such as first and surname, phone number, and email address. All of these details must be accurate to prevent delays in the transaction.

Benefits of making transactions to India using Payex Flo

Easy to initiate the transfer

Payex Flo provides its users with the ability to make international payments without following a lengthy procedure full of documentation. A Payex Flo user only needs to put in the required details and they will be all set to initiate the transfer. The user-friendly interface of Payex Flo doesn’t only allow the users to navigate the steps easily but to get done with these steps instantly.

Easily receivable transaction

The Payex Flo doesn’t only provide ease to the sender but the receiver as well. Once you make the transfer to India, the receiver residing in India will immediately notify you that he has received payment in his bank account. Moreover, the receiver doesn’t need to make a new account to make the payment. All he/she has to do is to have a bank account where the sent money could be deposited.

No more hidden charges

The world has been paying higher costs for international transfer for ages. Some banks get extra money by giving a high exchange rates while others demand high fees to make transfers. However, the Payex Flo doesn’t demand any extra charges from its users. All the charges and the exchange rates get finalized your valuation.

Fast, reliable and secure transfers

Be it a money transfer to India, Pakistan, or any part of the world; you can make it happen instantly to meet the financial demands of your friends and family.

Repeat transfers

Repeat transfer tends to be annoying when you have to input details every time you make the transaction. However, with the Payex Flo, repeated transfers become less tiresome. You can easily make repeat transfers on a regular basis without entering the details every time. You can save the details on Payex Flo. All you need to do is to enter the amount you are transferring.

Conclusion:

Make a fast, reliable and secure transfer to India using Payex Flo

With the Payex Flo, you will be more than satisfied after you make the transaction to India while saving up a lot on costs and money. You will no longer be strolling to banks to make monthly transactions to your destination country and can make repeat transfers instantly with the device you are holding in your hands.

Other Articles

- How to send money to mexico

- How to remit money to another bank account (explain)

- How to exchange money fast

- How to convert currency and send it to pakistan using payex plo

- How to convert currency and send it to india using payex flo

- How to change money online (how to use payex flo and other alternatives...

- Exchange money brokers

- Cheap money exchange

- Cheap money transfer

- HOW TO REMIT MONEY TO SOMEONE ELSE'S BANK ACCOUNT

Payex Flo does not onboard clients, is an introducing agent and does not engage with the Users of this website hereinafter (“The User”) in any way, it serves only as a point of internet traffic referral, Payex Flo won’t provide any services to the User under any circumstances. Under applicable regulation all financial services provided to the User will be delivered by a regulated entity based on the location of the client and under applicable regulation.

Some locations shown on the menus could be unavailable, restricted or are in some cases blacklisted or under a sanction lists making such transfers impossible or illegal, in such cases the User may not be able to receive any service from any of the regulated entities or 3rd parties.

Because the transfer service is provided by 3rd parties, Payex Flo cannot guarantee in any way that the services being referred will be delivered, 3rd parties will under applicable regulation validate both the User and the destination of the transfer and no wire will be allowed until the account and the subsequent operation is authorized by such 3rd party.

All Users will require to undergo AML/KYC checks under applicable regulation by the regulated entity, if the entity providing such services does not approve the User you will not be able to send money. Payex Flo shall not be responsible for any denial of service by the 3rd parties.

By using this website you are hereby authorizing Payex Flo, its agents and representatives to share any relevant information including without limitation your IP Address, your email, the Country of Origin and Destination where you intend to transfer money to and other relevant information you provide any 3rd party it may choose to engage in the context of the traffic referral. We are not responsible by any error or omission made by the User while posting the transaction details in or otherwise providing the information required to avail of a facility, or any consequences of such error or omission.

Although Payex Flo adopts security measures which it considers appropriate for the web-site it does not warrant that the web-site is immune from hacking, unauthorized access that may impair the working of the web-site. Payex Flo has not verified and shall not be responsible for any information or content on the web-site or on web-sites linked to or with the web-site.

All entities referred as 3rd parties are regulated and supervised, the access and use of the web-site and the exchange of information provided to the website is entirely at the users own risk.

The information, material, suggestions, displayed on the web-site are termed as content and Payex Flo assumes no responsibility for any mistakes, omissions, inaccuracies, typographical errors or otherwise inaccurate or available data and does not take any warranty regarding any content on the web-site.

All Rights Reserved © 2020 Payex Flo